Green corporate finance is taking Australia by storm, and it’s not just tree-huggers cheering. Big banks, mining giants, and even your local brewery are jumping on the bandwagon. But what exactly is this green buzz, and why is Australia leading the charge Down Under?

Let’s break it down – no jargon, no eye-rolls, just the good stuff.

What Even Is Green Corporate Finance?

At its core, green corporate finance is about raising and using money for projects that don’t wreck the planet. Think solar farms, wind turbines, electric vehicle fleets, or retrofitting factories to run on clean energy. Instead of funding coal plants (yikes, 2005 called), companies are now issuing green bonds, taking sustainability-linked loans, or investing in ESG (Environmental, Social, Governance) funds.

It’s like regular finance, but with a conscience – and a marketing glow-up.

In Australia, this isn’t just a trend. It’s a full-blown movement. Why? Because we’ve got sunshine for days, wind off the coast, and a government finally waking up to climate change. Plus, investors are done with dirty profits. They want returns and a future where koalas don’t roast.

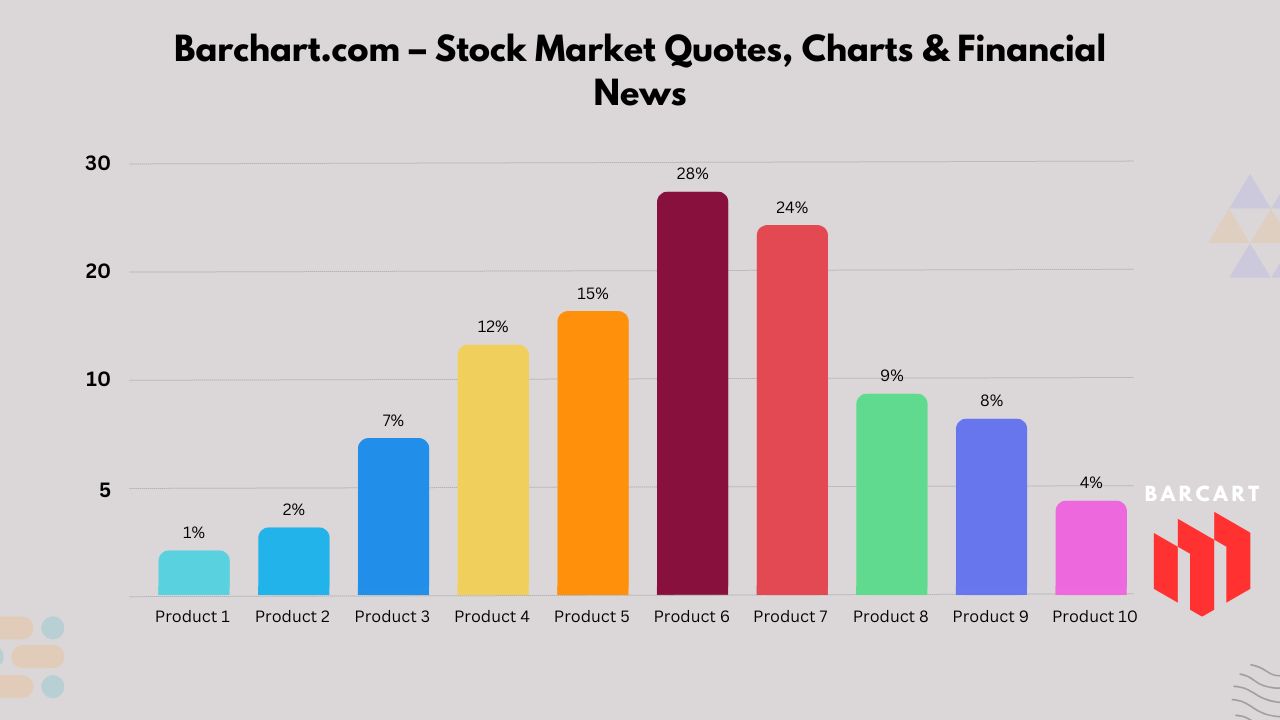

The Numbers Don’t Lie (But They Do Impress)

According to the Clean Energy Finance Corporation (CEFC), over $40 billion has been committed to clean energy projects since 2013. That’s not pocket change. That’s build-a-thousand-wind-farms money.

In 2024 alone, green bond issuance in Australia hit $25 billion, up 60% from the previous year. Companies like Telstra, Qantas, and even property developers are issuing these bonds faster than you can say “carbon neutral by 2050.”

And here’s the kicker: green loans now come with lower interest rates if you meet sustainability targets. Miss your emissions goal? Pay more. Hit it? Save cash. It’s like a gym membership, but for the planet.

Why Australia? Sunshine, Policy, and Peer Pressure

Australia’s got the perfect recipe for green finance:

- Abundant Renewables – We’re the sunniest continent. Why import oil when you can harvest rays?

- Government Muscle – The CEFC and Australian Renewable Energy Agency (ARENA) are pumping billions into green tech. It’s like having rich uncles who only fund solar panels.

- Global Pressure – Investors overseas won’t touch “brown” companies anymore. Want European funding? Better go green or go home.

Add in the National Reconstruction Fund and tax incentives for green capex, and suddenly, going green isn’t just noble – it’s profitable.

“Going green used to be like eating kale – good for you, but kinda painful. Now? It’s like kale smoothies with a side of tax breaks.”

Big Players Going Green (And Making Bank)

Let’s talk about the heavy hitters:

- Commonwealth Bank: Issued $2 billion in green bonds to fund renewable energy and low-carbon buildings.

- Westpac: Launched a climate bond program targeting $1 billion annually for green projects.

- BHP: The mining giant (yes, that BHP) is investing $400 million in carbon capture and green steel. Even the diggers are decarbonising.

And it’s not just corporates. Super funds like AustralianSuper and Hostplus are diverting billions into ESG assets. Your retirement money? Probably funding a wind farm in Victoria right now.

The Rise of Green Bonds: Debt with a Halo

Green bonds are the poster child of this movement. They’re regular bonds, but the money only funds eco-friendly projects. Transparency is key – issuers must report how the cash is spent, or they lose the “green” label (and investor trust).

In Australia, the Climate Bonds Initiative certifies these bonds. As of 2025, over 70 Australian entities have issued certified green bonds. From universities to water utilities, everyone’s in.

Fun fact: The University of Melbourne issued a $100 million green bond to fund energy-efficient campus upgrades. Students now study under LED lights powered by rooftop solar. Eat your heart out, Hogwarts.

Sustainability-Linked Loans: Pay Less, Pollute Less

These loans are the new cool kid. Interest rates are tied to KPIs (key performance indicators) like reducing emissions or increasing renewable energy use. Hit your targets? Get a discount. Miss them? Pay a penalty.

It’s like a corporate version of “no dessert until you finish your veggies.”

Banks like ANZ and NAB are offering these loans left and right. One mid-sized manufacturer in Queensland saved $1.2 million in interest by switching 80% of its fleet to electric vehicles. That’s a lot of avocado toast.

Challenges? Sure. But Nothing a Cold VB Can’t Fix.

Not everything’s rainbows and wind turbines. Challenges include:

- Greenwashing Risk: Some companies slap “green” on projects that are barely eco-friendly. Regulators are cracking down, but buyers beware.

- High Upfront Costs: Solar farms don’t build themselves (yet). Initial capex can scare off smaller firms.

- Data Gaps: Measuring Scope 3 emissions (supply chain) is harder than herding cats.

But here’s the thing: the Australian Securities and Investments Commission (ASIC) is now policing greenwashing like a hawk. Mislabel a bond? Face fines. Lie about emissions? See you in court.

The Future: Greener Pastures Ahead

By 2030, experts predict $100 billion in annual green finance flows in Australia. That’s enough to fund:

- 50,000 MW of new renewable capacity

- 1 million electric vehicle charging stations

- Retrofitting 500,000 homes for energy efficiency

And the best part? Jobs. The green finance boom is creating roles in compliance, ESG analysis, and renewable project finance. Forget law school – study sustainability.

How Businesses Can Jump In (Without Tripping)

Ready to go green but don’t know where to start? Here’s a simple playbook:

- Audit Your Emissions – Know your carbon footprint. Tools like the Greenhouse Gas Protocol help.

- Set Science-Based Targets – Align with the Paris Agreement. Investors love this.

- Talk to Your Bank – Ask about green loans or bonds. They’re begging to lend.

- Issue a Sustainability Report – Transparency builds trust (and attracts capital).

- Hire an ESG Consultant – Yes, they exist. No, they’re not just for virtue signalling.

Pro tip: If your CFO still thinks “ESG” stands for “Extra Salad Greens,” it’s time for a chat.

Why This Matters (Beyond Saving Koalas)

Green corporate finance isn’t just about the planet. It’s about:

- Risk Mitigation: Climate change = supply chain chaos. Green investments = stability.

- Brand Love: Consumers prefer eco-friendly brands. Fact.

- Regulatory Survival: Net zero laws are coming. Get ahead or get fined.

Australia’s on the cusp of a green financial revolution. Banks, super funds, and corporates are aligning profit with purpose. And honestly? It’s about time.

Final Thoughts: Green Today, Rich Tomorrow

The rise of green corporate finance in Australia isn’t a fad. It’s the future. From Bondi to the Bush, businesses are proving you can make money and save the planet. Sure, there are hurdles, but with government backing, investor demand, and a bit of Aussie ingenuity, we’re on track.

So next time your company debates a new project, ask: “Can we make this green?” The answer might just be the smartest investment you’ll ever make.

And if anyone complains about the cost, remind them: the planet’s not on a subscription model – but going green might get you a discount.