Let’s be honest: investing in real estate can feel like trying to solve a Rubik’s cube blindfolded while riding a unicycle. But in 2026, with the right moves, it doesn’t have to be that hard. The market is shifting, interest rates are doing their usual dance, and new tech is making things both easier and more confusing. So grab a coffee (or something stronger), and let’s break down the top real estate investment tips for 2026 in plain English—no jargon, no fluff, just stuff that works.

And yes, I promise not to say “location, location, location” more than three times. Okay, maybe four.

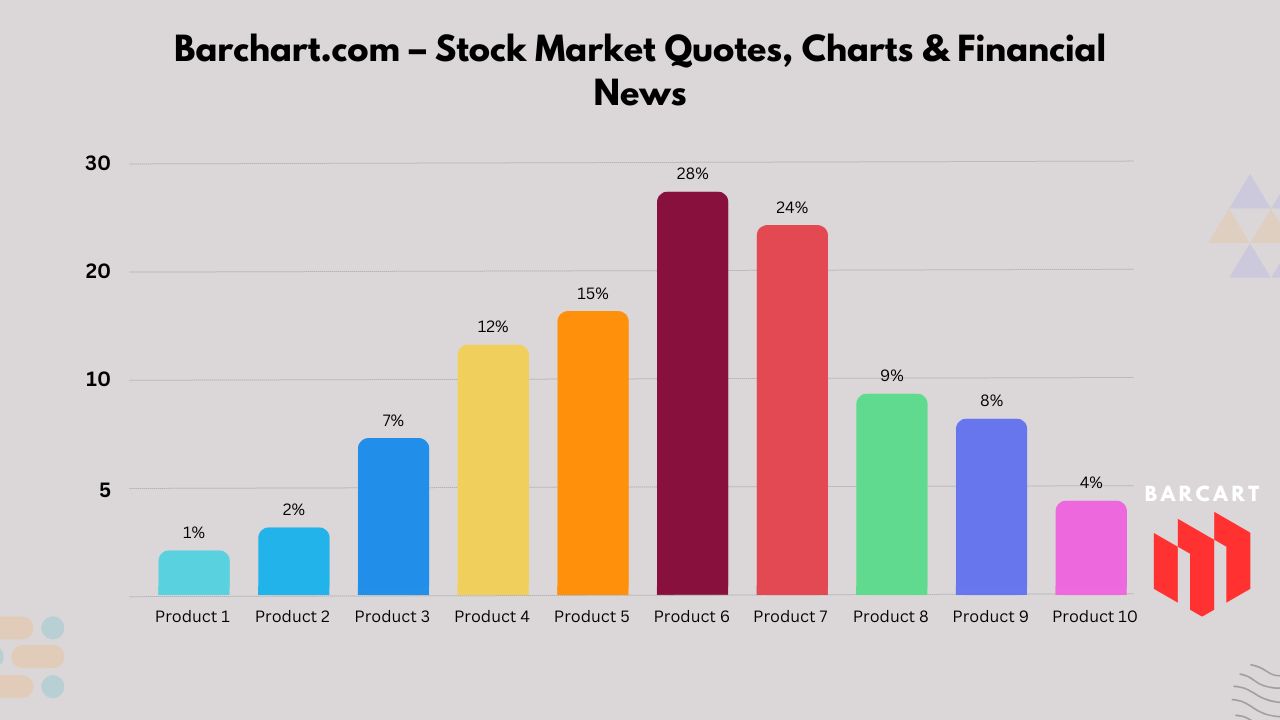

1. Don’t Chase the Hype—Follow the Data

Everyone loves a hot market. “Miami is exploding!” “Austin is the new Silicon Valley!” Sure, until three years later when half the condos are empty and the only thing exploding is your stress level.

In 2026, smart investors follow the numbers, not the TikTok trends. Look at:

- Job growth (where are companies hiring?)

- Population migration (people are still leaving high-tax states)

- Infrastructure projects (new highways, airports, or transit lines = future value)

Pro tip: Use free tools like the U.S. Census Bureau or local government planning reports. If a city is building a new Amazon warehouse or a light rail line, that’s your green light.

Funny line alert: Investing based on hype is like buying a house because your Uber driver said it’s “up and coming.” Cute story. Terrible strategy.

2. Buy Ugly, Win Big (But Not Too Ugly)

The best deals in 2026? Cosmetic fixer-uppers. Not the ones where the roof is caving in and the foundation is held together by hope and duct tape. I’m talking about the house with avocado-green bathrooms, popcorn ceilings, and carpet that smells like 1973.

Why? Because most buyers want move-in ready. They see ugly tile and run. You see profit.

A $5,000 kitchen refresh and a $3,000 paint job can boost value by $30,000+. That’s not math—that’s magic.

2026 Bonus: With remote work still strong, people want homes with home offices. Convert that weird extra bedroom (or the closet under the stairs—Harry Potter vibes) into a functional workspace. Boom. Instant value.

3. Rental Properties: Cash Flow Is King

If you want passive income (and who doesn’t?), rental properties are still golden in 2026. But here’s the golden rule: Cash flow must beat your mortgage, taxes, insurance, and a surprise water heater explosion.

Use the 1% Rule as a quick filter: Monthly rent should be at least 1% of the purchase price.

Example:

- House costs $300,000

- Rent should be at least $3,000/month

If it’s not, keep looking.

Hot markets for rentals in 2026:

- Mid-sized cities like Raleigh, Charlotte, Boise, and Nashville

- Suburbs near major hubs (people want space but not a 2-hour commute)

Warning: Don’t fall in love with a property. Fall in love with the spreadsheet.

4. Short-Term Rentals: Airbnb Is Evolving

Airbnb isn’t dead—it’s just growing up.

In 2026, short-term rental success = hyper-local strategy. That means:

- Research local regulations (some cities now require permits or limit rental days)

- Target niche travelers: digital nomads, medical tourists, wedding parties

- Furnish like a boutique hotel (yes, that means actual matching towels)

Funny but true: If your listing photos look like they were taken with a potato, no amount of “cozy” in the description will save you.

Use tools like AirDNA or Mashvisor to see what’s booking in your area. If 3-bedroom homes near the hospital are renting for $250/night, that’s your target.

5. Interest Rates: Don’t Panic, Plan

Yes, rates went up. Yes, they might go down. No, you don’t need a crystal ball.

Here’s the truth: You make money when you buy, not when you sell.

In 2026, lock in a fixed-rate mortgage if you can. Even at 6.5%, a good deal still cash flows. And if rates drop? Refinance later. It’s not rocket science—it’s house science.

Intermediate investor move: Consider adjustable-rate mortgages (ARMs) only if you plan to sell or refinance within 5–7 years. Risky? Yes. Rewarding? Sometimes.

6. Multifamily Is the New Black

Single-family homes are great. But duplexes, triplexes, and fourplexes? That’s where the real money hides.

Why?

- One mortgage, multiple rents

- Tenants pay your loan

- Easier to manage than 10 separate houses

In 2026, look for older multifamily units in gentrifying neighborhoods. They’re often underpriced because sellers think “old = bad.” You think “old = opportunity.”

Real example: A 4-unit building in Ohio bought for $420,000 now brings in $4,800/month in rent. That’s $57,600/year in income. The mortgage? $2,400/month. Cha-ching.

7. Partner Up (But Not With Your Cousin Vinny)

Want to buy bigger properties but don’t have $500K lying around? Find a partner.

Good partners:

- Have cash or credit

- Share your goals

- Don’t cry when the AC dies in July

Bad partners:

- Think “real estate = get rich quick”

- Disappear when it’s time to fix the toilet

Use platforms like BiggerPockets or local real estate meetups to network. And always, always put everything in writing.

Authority link: BiggerPockets – How to Find Real Estate Partners

8. Tech Is Your Friend (But Not Your Overlord)

In 2026, AI and proptech are changing everything:

- Zillow 3D tours let you “walk” a property from your couch

- PropStream shows foreclosure and motivated seller leads

- DealMachine helps you find off-market deals while driving for dollars

But here’s the catch: Tech doesn’t replace hustle. You still need to talk to sellers, walk the neighborhood, and smell the basement for water damage.

Funny line: If you’re making offers based only on an algorithm, congrats—you’re gambling with extra steps.

9. Tax Breaks Are Your Secret Weapon

Real estate isn’t just about cash flow—it’s about tax advantages.

In 2026, don’t sleep on:

- Depreciation (write off the “wear and tear” of your property)

- 1031 Exchange (sell one property, buy another, defer capital gains tax)

- Cost segregation (accelerate depreciation on certain parts of the building)

Talk to a CPA. Yes, they’re boring. But they’ll save you thousands.

Authority link: IRS – Real Estate Tax Tips

10. Don’t Forget to Live a Little

Here’s the most underrated tip: Real estate shouldn’t own your life.

I’ve seen investors buy 17 properties and forget their kid’s name. Don’t be that guy.

Set a goal:

- “I want $5,000/month in passive income by 2030.”

- Then reverse-engineer it.

Buy one property. Learn. Fix mistakes. Buy another.

Final funny line: Real estate is a marathon, not a sprint. Unless the house is on fire. Then sprint.

Final Thoughts: Start Small, Think Big

You don’t need to be a millionaire to invest in real estate in 2026. You need patience, a calculator, and the ability to say no to shiny objects.

Start with:

- A single rental

- A fix-and-flip

- A partnership on a duplex

One deal turns into two. Two turns into five. Five turns into “I just paid cash for a beach house.”

And if you’re still scared? Remember: The best time to invest was 10 years ago. The second-best time is now.

Now go forth, buy smart, and may your tenants always pay on time (and never flush wet wipes).

Happy investing!